Investing in an Election Year

It’s 2020, the beginning of a presidential election year. As the months unfold, the election will likely become the primary market risk to worry about for many people. Democratic primary voting will begin in February with the Iowa caucuses, but only 4 percent of the delegates will be chosen that month. The party’s direction won’t begin to unfold until March 3, when 34 percent of the delegates will be chosen by 14 states. But we still won’t have clarity at that point, as delegates are distributed proportionally for each state by the Democratic Party. With several candidates polling in the double digits, a lot of uncertainty regarding the Democratic nominee may exist right up to the July convention. Although the bull market has lasted more than a decade, will valuations keep moving higher in this uncertain political climate?

Which Direction for the Democrats?

The winner of the Democratic primary will be important, as significant policy differences exist between the two wings of the Democratic Party vying to steer its—and the country’s—direction. The current front-runners on the progressive left, Bernie Sanders and Elizabeth Warren, are proposing the biggest changes to health care, education, climate and economic policy, as well as the tax code. Whether the candidate is from the progressive left or the moderate wing will determine the degree of the party’s policy differences from President Trump’s Republican administration. Uncertainty regarding policy conflicts will create considerable angst among investors as November approaches. The market will likely experience some volatility, as participants digest the possibility of an incoming Democratic administration making changes to the tax code for corporations or individuals. Another risk factor is the potential for increasing trade tensions should Trump be reelected.

Control of Congress

Let’s not lose sight of the larger picture, however. The 2020 election is not just about the presidency. There will also be elections in the House and Senate. Both parties will likely face uphill battles for control of each branch of Congress, and neither party is likely to gain a significant advantage. Many House districts aren’t expected to be competitive, and the 2020 Senate map favors Republicans. The separation of power should limit some of the most aggressive party proposals from being implemented. While regulatory and trade proposals can be implemented outside of congressional approval, proposals on taxes and health care will require the approval of Congress. If a single party controls both the presidency and Congress, we could see more significant changes. But there are still limits as to what changes can be effected with a simple majority.

Political Bias and Economic Outlook

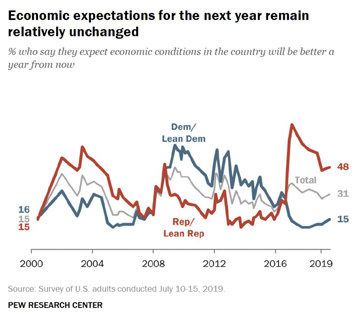

Despite the limitations of divided government, many investors allow their political bias to affect their outlook on the economy. The two charts to the right show people’s views of the current economy and their outlook based on their political affiliation.

We’ve been in the same bull market since 2009. Yet the 2016 election flipped people’s viewpoints on the economy depending on whether they considered themselves a Republican or Democrat. This bias may have led Republicans to miss out on some of the early recovery, while Democrats may have missed out on the last few years of growth. So, when looking at the outcome of an election, it’s important to understand the implications of possible policies. Don’t overestimate the risks of the other party’s policies when making investment decisions.

What Does History Tell Us?

Looking at historical figures in the charts below, you can see that S&P 500 returns were positive in 14 of the past 17 election years, with only two exceptions: the years of the tech bubble bust and the global financial crisis. In the year following an election, however, the picture has been more mixed. Eight of the last 9 years have shown gains, with 6 years of returns in the double digits.

Focusing on Fundamentals

There is always the possibility that we’ll get a wave election, with big gains by one party that rattle the markets. In the long run, however, the biggest risk to your investments is still a recession, not the outcome of the election. Presidential politics will certainly play a role in the economy, but don’t get caught in election headlines while ignoring investment fundamentals.

Editor’s Note: The original version of this article appeared on the Independent Market Observer.

The information on this website is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets.

The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. All indices are unmanaged and investors cannot invest directly into an index.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float‐adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consists of 21 developed market country indices.

Third-party links are provided to you as a courtesy. We make no representation as to the completeness or accuracy of information provided at these websites. Information on such sites, including third-party links contained within, should not be construed as an endorsement or adoption by Commonwealth of any kind. You should consult with a financial advisor regarding your specific situation.

Please review our Terms of Use.