2025 Midyear Outlook: Big Expectations and Big Uncertainty for Equities

Equities have been on quite the roller coaster in 2025. Although the tariff situation has driven much of this volatility, we find ourselves in a similar spot to where we began the year. Valuations remain high, the market is still counting on the growth of the Magnificent 7 (Mag 7), and analysts continue to expect above-average growth for the next several years, despite all the uncertainty.

To understand the equities outlook for the second half of the year, let’s first consider how we got here.

A Whirlwind of a First Half

At the start of 2025, analysts were expecting close to 15 percent earnings growth for the S&P 500. In the two quarters since, we’ve seen a similar story from a fundamental perspective—but with some key differences as to why. Each quarter saw earnings beat expectations by solid margins, but analysts then lowered future growth expectations, offsetting some of that positive news.

In the first quarter, lowered growth expectations hit the tech sector and the Mag 7 particularly hard. Analysts began to see a deceleration in growth projections for companies whose valuations relied on significant future growth projections. In the second quarter, most of those companies beat lowered expectations, with investment spending for AI continuing at a strong pace despite business concerns over tariffs and the broader economy.

The future growth expectations for tech and communications services also held up well, leading to a rebound for growth companies dominated by those sectors. Despite a majority of cyclical sectors beating their first-quarter growth estimates, companies and analysts had concerns over tariffs and the economy, leading to lowered future estimates.

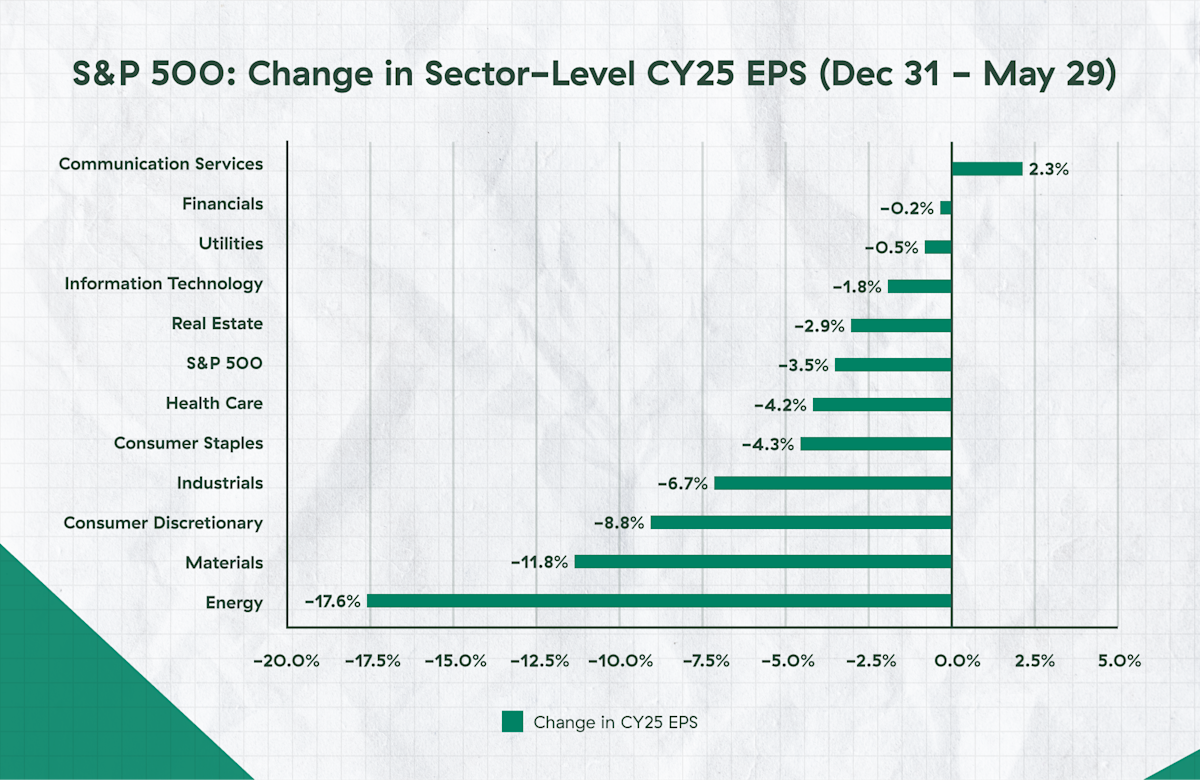

In the chart below, you can see the full impact of all the analyst changes to estimates since the beginning of the year.

Source: FactSet as of 5/30/2025

A Tale of Two Markets

There are various ways to categorize the markets: large-caps versus small-caps, U.S. versus international, and value versus growth. But the biggest divide for the past few years? The Mag 7 versus everyone else.

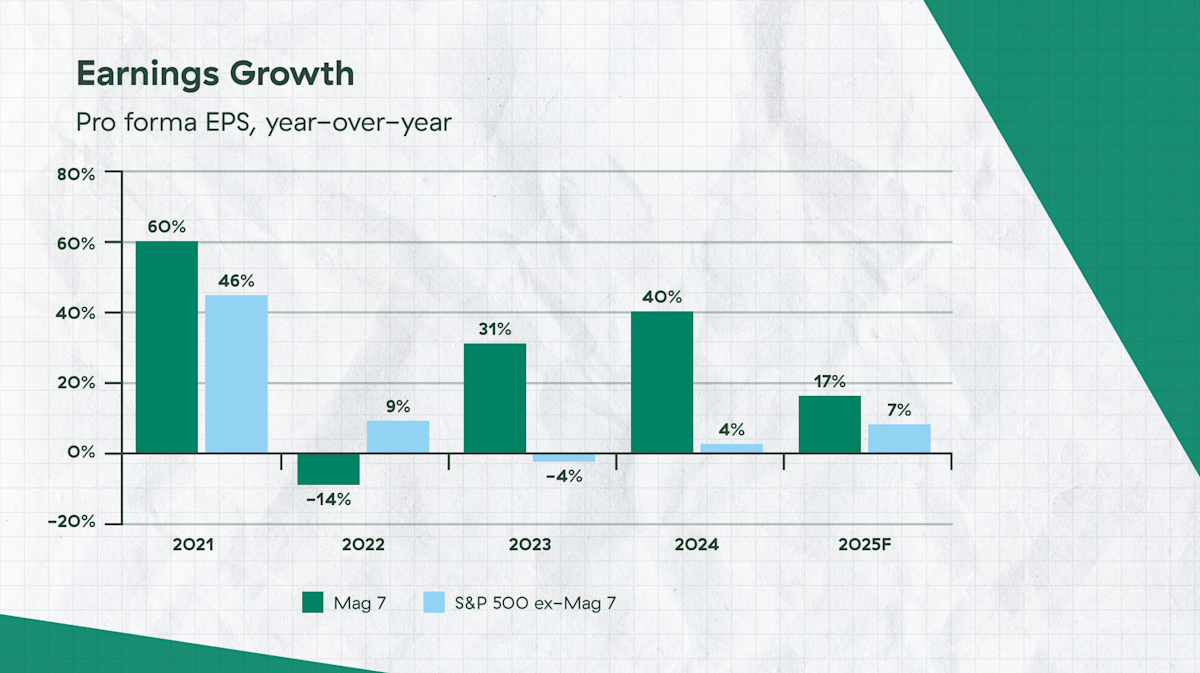

The recurring story over the past year and a half has been the growth of the top companies declining toward the rest of the S&P 500 but continually managing to beat those expectations. Mag 7 valuations remain well above the rest of the S&P 500, but they are still expected to see 17 percent earnings growth for 2025 versus 7 percent for the rest of the index.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA, and TSLA. Earnings estimates for 2025 are forecasts based on consensus analyst expectations. Guide to the Markets – U.S. Data as of June 6, 2025.

The biggest potential driver for continued S&P 500 growth remains the ability of companies heavily involved in the AI revolution to beat growth projections. Given the positive outlook from the Mag 7 in their Q1 earnings calls and many of those in their supply chain, we see solid growth continuing in the second half of the year.

Here, it’s important to keep in mind that markets are forward-looking. As we continue through the year, the major risk to the outlook is that markets start to see the end of above-average growth, which would bring valuations down. As we saw in 2022’s “tech wreck” due to rising rates, the drop can be quick and significant. Similarly, when analysts lowered future expectations earlier this year, we saw the Mag 7 decline significantly. Still, the growth of these companies has produced real profits that can’t be ignored—but investors may need to temper expectations given the high valuations.

What About Everything Else?

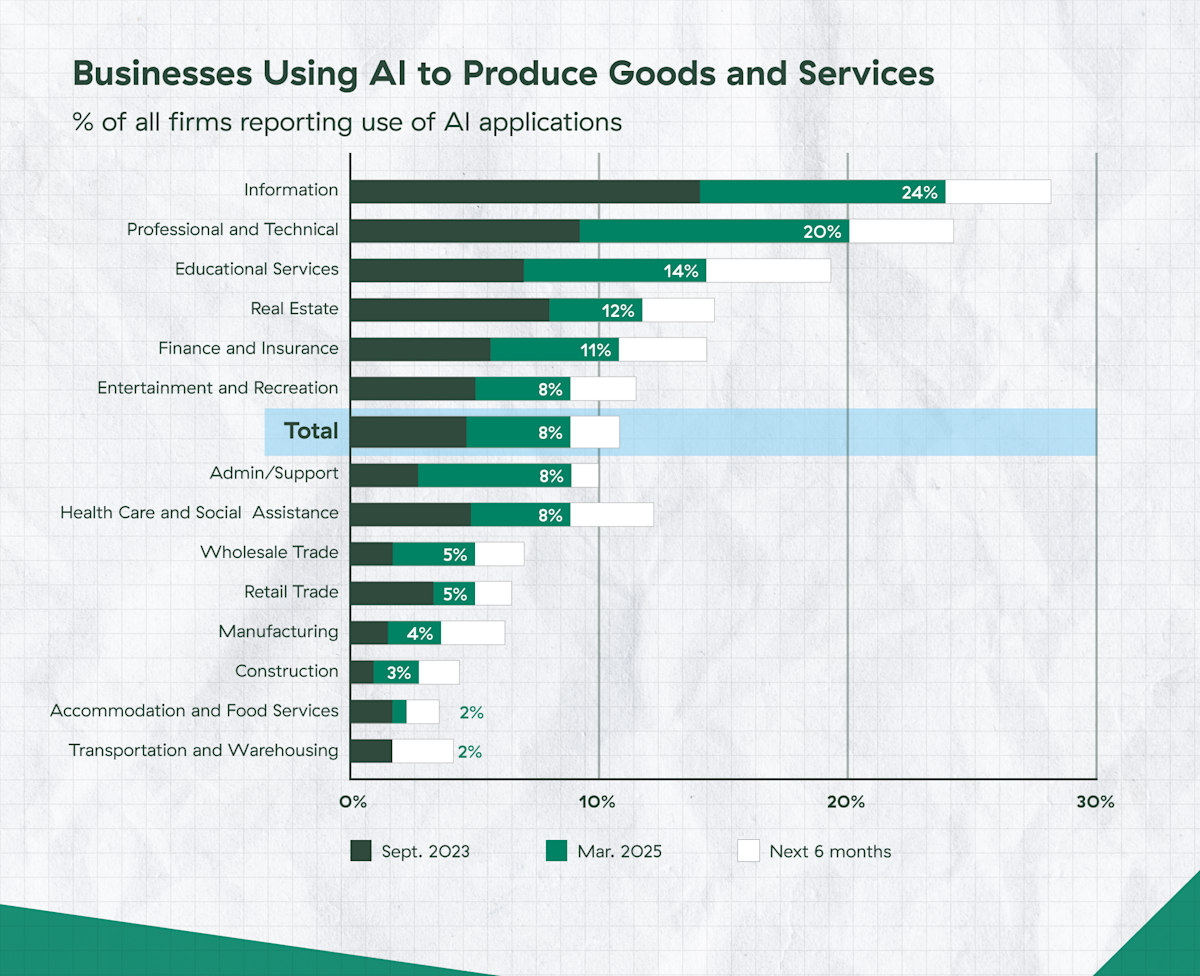

AI’s ability to help improve productivity in a still-tight labor market will be key to maintaining the Mag 7’s high profit margins, but also the profit margins of many other companies. To support the growth of the Mag 7, it will also likely be necessary for AI to have a major impact on other companies.

Source: J.P. Morgan Asset Management; BEA. Guide to the Markets-U.S. Data as of June 6, 2025.

The ability to adapt and use AI is certainly prevalent in tech, but it has several applications in other industries. This could help lead to increasing growth elsewhere (see chart below).

Source: Census Business Trends and Outlook Survey (AI Supplement). Guide to the Markets-U.S. Data as of June 6, 2025.

2025 earnings growth expectations for value companies are only 5 percent, compared to 14 percent for growth companies. Still, they are trading at a 40 percent discount on a forward P/E basis. This leaves a lot more room for error if those companies can’t live up to expectations. Given that analyst estimates have been lowered due to the uncertainty over continued tariffs, there is still space for improvement if the level of the announced tariffs continues to decline.

Currently, mid-cap companies have the same earnings growth expectations as large-caps with lower valuations, while small-caps have significantly higher growth expectations. In the past two years, small-caps have not come close to meeting high expectations, leading to underperformance. But if projections are in line with analyst estimates for 30 percent growth, there is significant potential there.

International equities have been the biggest story outside of the Mag 7 so far this year. The MSCI AC World ex U.S. Index has outperformed the S&P 500 by just over 13 percent (year-to-date through June 6, 2025). Still, after nearly a decade and a half of underperformance, those companies are trading at a significant discount relative to their 20-year history. Given the continued positive economic surprises happening internationally, along with still-subdued valuations relative to the U.S., international outperformance could continue in the second half of the year.

Long-Term Plays for Portfolios

Looking toward the back half of 2025, several plausible stories could unfold. Markets may rise significantly on the back of increased AI growth, with the rest of the market seeing solid growth and valuations continuing to build on increased excitement. Or the Mag 7 may have a reset in valuations, while the rest of the market manages to outperform expectations and markets remain flat. Then there is the possibility that economic growth could slow significantly, hurting both the biggest and smallest names.

The bottom line is this: equity investors are paid to take risks. They must determine what the most likely scenario is and how much risk they can afford. Having exposure to the biggest names in the index can still make sense given their profitability and growth prospects. But with the valuation disconnect, international equities and, to a lesser extent, small- and mid-cap names may be attractive in the long term as the benefits from AI expand beyond the Mag 7.

Don't miss tomorrow's post, which will feature a special Midyear Outlook edition of the Market Observatory.

Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets.

The forward price-to-earnings (P/E) ratio divides the current share price of the index by its estimated future earnings.[JH1]

The Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) are a group of seven companies commonly recognized for their market dominance, their technological impact, and their changes to consumer behavior and economic trends.

The MSCI ACWI ex USA is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It does not include the United States.

The information on this website is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets.

The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. All indices are unmanaged and investors cannot invest directly into an index.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float‐adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consists of 21 developed market country indices.

Third-party links are provided to you as a courtesy. We make no representation as to the completeness or accuracy of information provided at these websites. Information on such sites, including third-party links contained within, should not be construed as an endorsement or adoption by Commonwealth of any kind. You should consult with a financial advisor regarding your specific situation.

Please review our Terms of Use.