Our Corporate Social Responsibility

At Commonwealth, we’ve always been devoted to doing what’s best for those around us. So, we formalized that commitment to turn social responsibility ideals into actions.

A pledge

Incorporating sustainable business practices into our firm isn't a onetime investment. It's a dynamic pledge led by a dedicated committee that requires transparency, accountability, and constant evolution. When we embrace sustainable principles and continuously improve our practices, we enhance the physical, emotional, and financial well-being of the entire Commonwealth community.

Part of our mission has always been to make a profound difference in our world. This corporate social responsibility committee was formed to serve as a springboard for change. I’m very excited to work with this dedicated group and help this initiative evolve.

Three spheres shape our social responsibility:

- 1Environmental, social, and corporate governance (ESG)

- 2Sustainable investing

- 3Giving back

Get the full report for a detailed look into our Corporate Social Responsibility pillars, progress, and plans for the future.

The ESG principle

As sound corporate citizens, we embrace environmental, social, and corporate governance principles and perspectives. Using a grassroots approach, we enact small, yet significant, ESG-focused changes in our ongoing operations.

Environmental impact

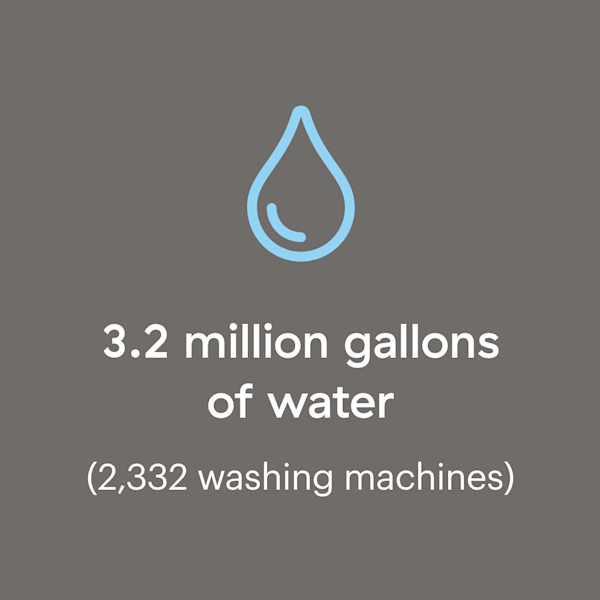

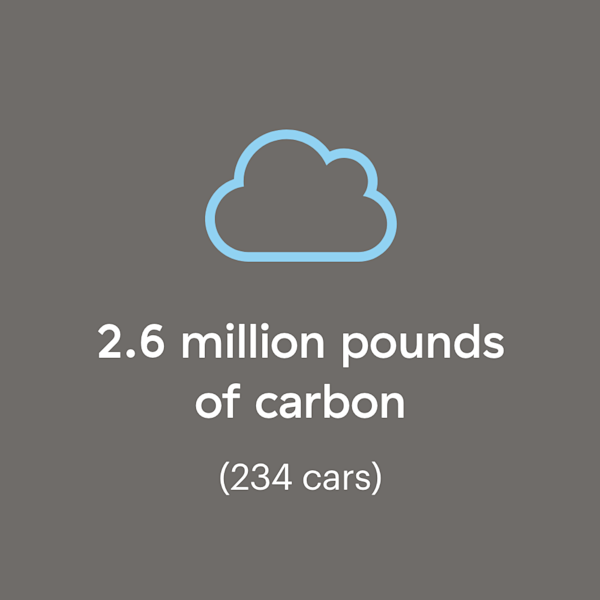

We are choosing sustainable alternatives, from creating more energy-efficient office buildings and reducing waste to cutting energy usage and carbon emissions.

Social connectivity

Creating meaningful connections, learning, and growth informed by employee feedback is key to our uncommon culture. We drive it home with the intentional use of diversity, equity, and inclusion practices.

Strong governance

We have a culture of sound business practices that begin with a Code of Ethics/Conduct, are rounded out by commitments to customer and corporate privacy, and include business continuity and disaster recovery plans.

Sustainable investing practices

The firm has been a believer in sustainable investing since 2008. We offer educational resources, robust research on the ESG landscape, and insights that are constantly evolving to meet investors' preferences. Our advisors use our ESG models to meet their clients' sustainable investing interests.

- Commonwealth's ESG models are used by more than 500 advisors and hold more than $500 million in assets under management.1

- Our quarterly ESG Reference Guide recommends dedicated ESG strategies and managers in the space to affiliated advisors.

- The firm's sustainable investing newsletter educates advisors' clients on the environmental and social impact of their investments.

Our sustainable investment selections keep growing.

Data above is as of August 2021

Giving back

Employees and affiliated advisors give of their time and talents all year long to support more than 60 annual events sponsored by Commonwealth. Each event benefits a nonprofit organization and contributes to our deep belief in paying it forward.

We are committed to acting as a steward for the environment, a leader for the community, and a firm governed by integrity.

1 Data as of November 26, 2021

This report is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product.

Investments are subject to risk, including the loss of principal. Environmental, social, and governance (ESG) criteria are a set of nonfinancial principles and standards used to evaluate potential investments. The incorporation of ESG principles provides a qualitative assessment that can factor heavily into the security selection process. The investment's socially responsible focus may limit the investment options available to the investor. Past performance is no guarantee of future results.