Deliver More Value to Clients by Outsourcing Investment Management

There’s been a dramatic shift in the financial advice model—from selling commission-based investment products to providing holistic wealth management services to clients. As a result, the scope of advice and services now goes well beyond managing portfolios. In fact, as clients demand more, their advisors need to position their differentiated services accordingly, especially in a competitive landscape plagued by fee compression.

With only so many hours in the day, how can you meet clients’ evolving preferences while still delivering a personalized touch?

Outsourcing investment management is one solution that can enable you to create operational efficiencies and scale your business while improving the client experience. Let’s take a closer look at what it can mean for your value proposition and how it could enable your firm to attract—and retain—quality clients.

Where Is Your Time Best Spent?

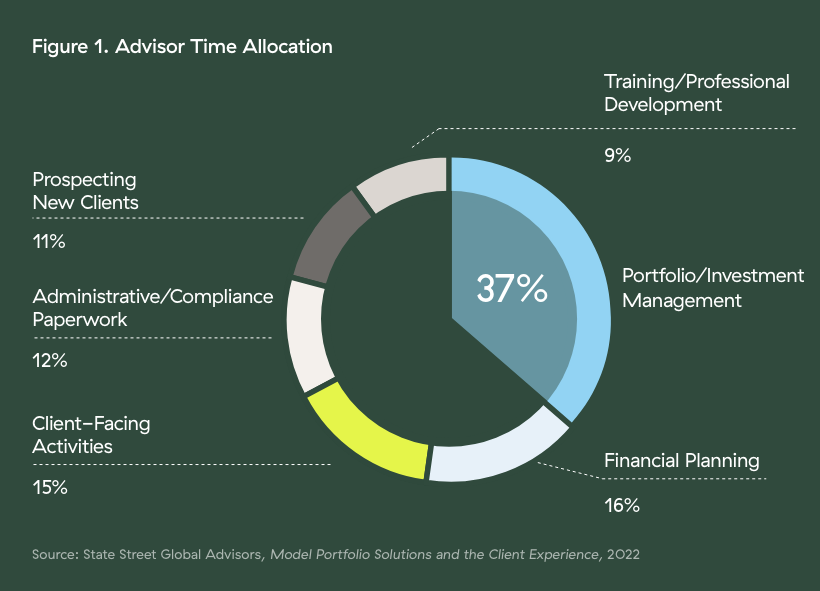

When you take the average 40-hour work week, how are you currently allocating your time? Are you focusing on the things that can deliver the most value to your clients? According to a study from State Street Global Advisors, on average, advisors spend more time on investment-related tasks, including investment research, investment management, and portfolio construction (totaling 37 percent), than on any other business or client-facing activity in a given week.

But when asked where they want to spend their time, the results told a different story:

62 percent want more time to focus on client-facing activities.

42 percent want to spend more time acquiring new clients.

43 percent want to spend more time on holistic financial planning.

If you can relate to the above statistics, ask yourself if you’re doing enough to foster meaningful client relationships, deliver holistic financial planning, and build a successful, scalable business. If the answer is no, outsourcing investment management may be the right solution for you.

A Strategic Approach to Adding Value

If your first thought is, “But I don’t want to stop investing for my high-net-worth clients,” the good news is it doesn’t need to be an all-or-nothing proposition. You can build a client segmentation and service model to strategically outsource some investment management, enabling you to generate operational efficiencies.

Many advisors focus on servicing top-tier clients and turn to an outsourced advisory solution for their strategic and legacy clients. This choice can enhance—rather than detract from—your value proposition.

By selectively outsourcing, you can give your clients access to institutional-quality investment management and a diversified range of professionally managed investment solutions. Plus, it can help remove the emotional aspect of investing during periods of market volatility by adhering to a consistent investment philosophy and process. March 2020, anyone?

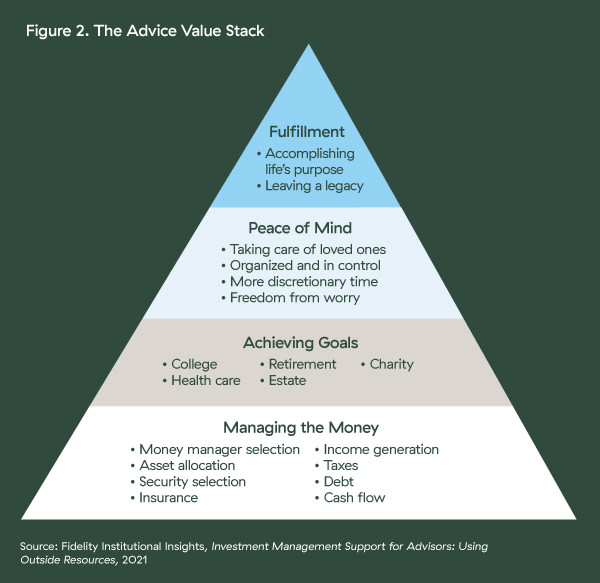

Perhaps the best way to contextualize the potential benefits of outsourcing investment management from both an advisor and a client perspective is through Fidelity’s Advice Value Stack (see Figure 2). The concept considers managing money a foundational element of the advisor-client relationship. But as investor perceptions of value evolve over time, advisors can offer different layers of value to clients throughout their financial journey.

Ultimately, greater value is associated with servicing clients at the top levels of the value stack. Helping clients achieve peace of mind and reach fulfillment, for example, are two key focal points, especially for millennials and the up-and-coming Gen Z cohort.

Unlike their baby-boomer parents, these younger demographics have shown a propensity for services that go beyond traditional financial guidance. These shifting preferences create opportunities for advisors to carve out more time to get in front of the next generation of investors—who are slated to control a significant share of the generational wealth transfer—and position their comprehensive wealth services accordingly.

With clients increasingly demanding holistic financial planning services, you can use the additional time you’ve freed up to guide them through each phase of their lives, including:

Personal finances

Home buying

Education planning

Social security and retirement planning

Health care in retirement

Estate planning

Finding the Right Solution for Your Outsourcing Needs

Now that you see the potential benefits of outsourcing some (or all) of your investment management, what’s the next step? There are hundreds of institutional managers to choose from, all offering different styles, investment vehicles, fee structures, and more. You’ll need to do a bit of legwork to find the one that works best for you. When doing your due diligence, you’ll want to:

Ensure that the manager has a clear, consistent investment philosophy and decision-making process.

Analyze the firm’s personnel and key decision-makers, including operational support, to gauge its size and expertise.

Evaluate the investment process to determine how a strategy should perform within its category, over time, and across changing market conditions.

Examine factors, such as risk exposure, fee structure, and level of support, to ensure that they align with your (and your clients’) investment goals.

Your partner firm may also offer an in-house solution. If this is the case, you can get the solutions you need while having access to a team of investment experts and support staff. At Commonwealth, our Preferred Portfolio Services® (PPS) Select program is focused on delivering everything advisors need to successfully outsource investment management, including:

More than 100 model portfolios, providing flexibility and diversification

Investment solutions designed to pursue competitive performance at scale

A team of investment research and advisory consultants offering support for every aspect of an advisor’s fee-based business

Don’t Get Left Behind

Jack Welch once famously said, “Change before you have to.” Many advisors have already shifted their value proposition and core competencies from stock pickers to holistic financial planners. If you’re still focusing on investment management and feeling crunched for time, you may want to consider delegating other areas of your business to a strategic partner.

By doing so, you’ll likely have more resources to develop client relationships and add value where clients want it most: being a trusted guide for their financial future.

The PPS Select program, available to clients through Commonwealth advisors, is a wrap program managed by Commonwealth’s Investment Management and Research team. In a PPS Select account, each client holds a selection of underlying securities in an asset-allocated portfolio. Investing is subject to risk, including the loss of principal, and there is no guarantee that any investing goal will be met.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.