8 Strategic Risks in Your Financial Advisory Practice

Business risk is anything that threatens the continued success of your practice, and it can assume many forms. Unfortunately, many business owners overlook the potential risks that can derail a long-standing business. By understanding and addressing the potential risks ahead, you’ll be better positioned to protect your business—and your clients.

To get you started, here are eight strategic risks to be aware of in your financial advisory practice.

Risk 1: Competition

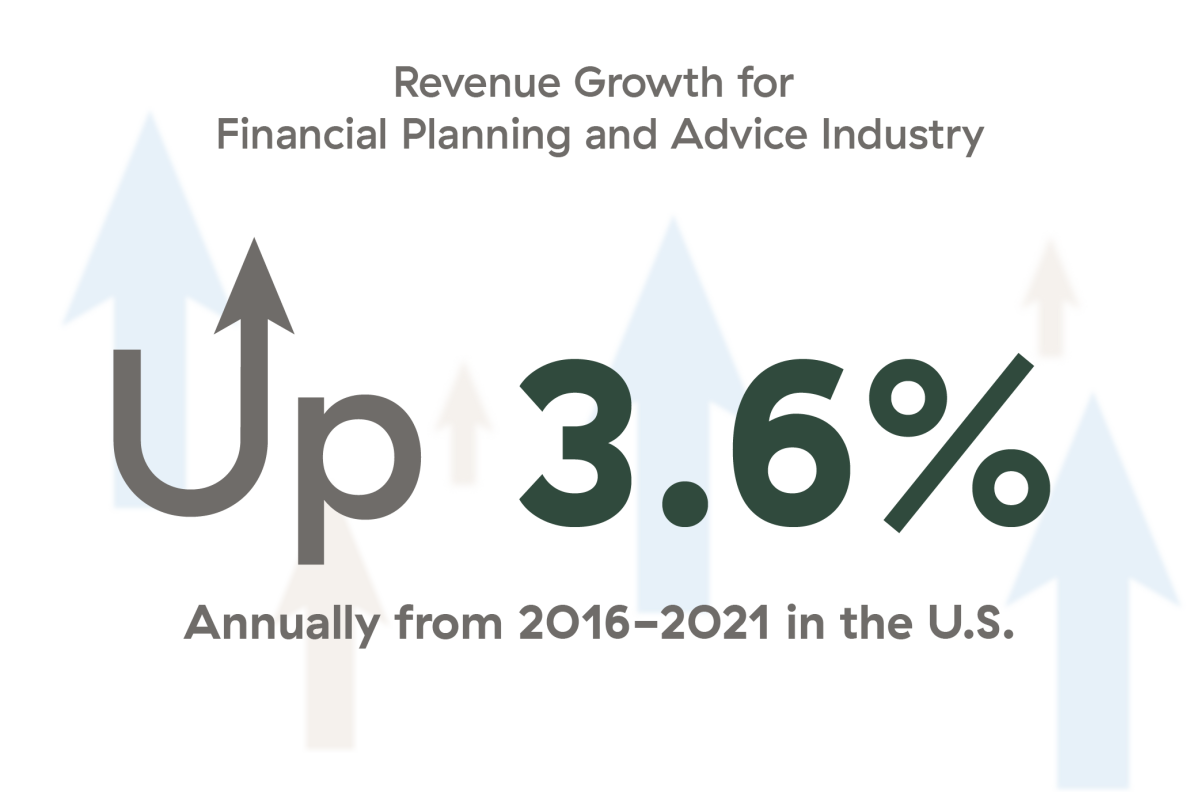

The competition present in the financial planning and advice industry is constantly growing and changing. According to the market research firm IBISWorld, Ameriprise Financial, Raymond James Financial, and Graystone Consulting hold the largest market share, and revenue across the U.S. financial planning and advice industry showed steady growth from 2016 to 2021:

The competition with robo-advisors is ongoing, with companies such as Wealthfront, Betterment, and Acorns providing state-of-the-art mobile applications and innovative investing methodologies.

Changing client demographics are calling for high-tech, high-touch services for the emerging affluent market. If you want to score new, ideal clients, consider exploring ways to reach out to millennials. And be prepared to clarify the competitive value you provide in areas such as service, trustworthiness, and quality relationships.

Risk 2: Revenue Growth Pressure

Smart growth will enable you to reinvest in more client services—a plus in this competitive market. Given fee compression and increased competition for client dollars, finding ways to grow is even more important. A few options for driving your firm's growth are:

Merging with or acquiring other firms

Building infrastructure

Segmenting services for clients

As a word to the wise, consider that growth is good and necessary for a thriving business, but growing inefficiently will only dilute the high level of service and value you bring to clients.

Risk 3: Specialization Demands

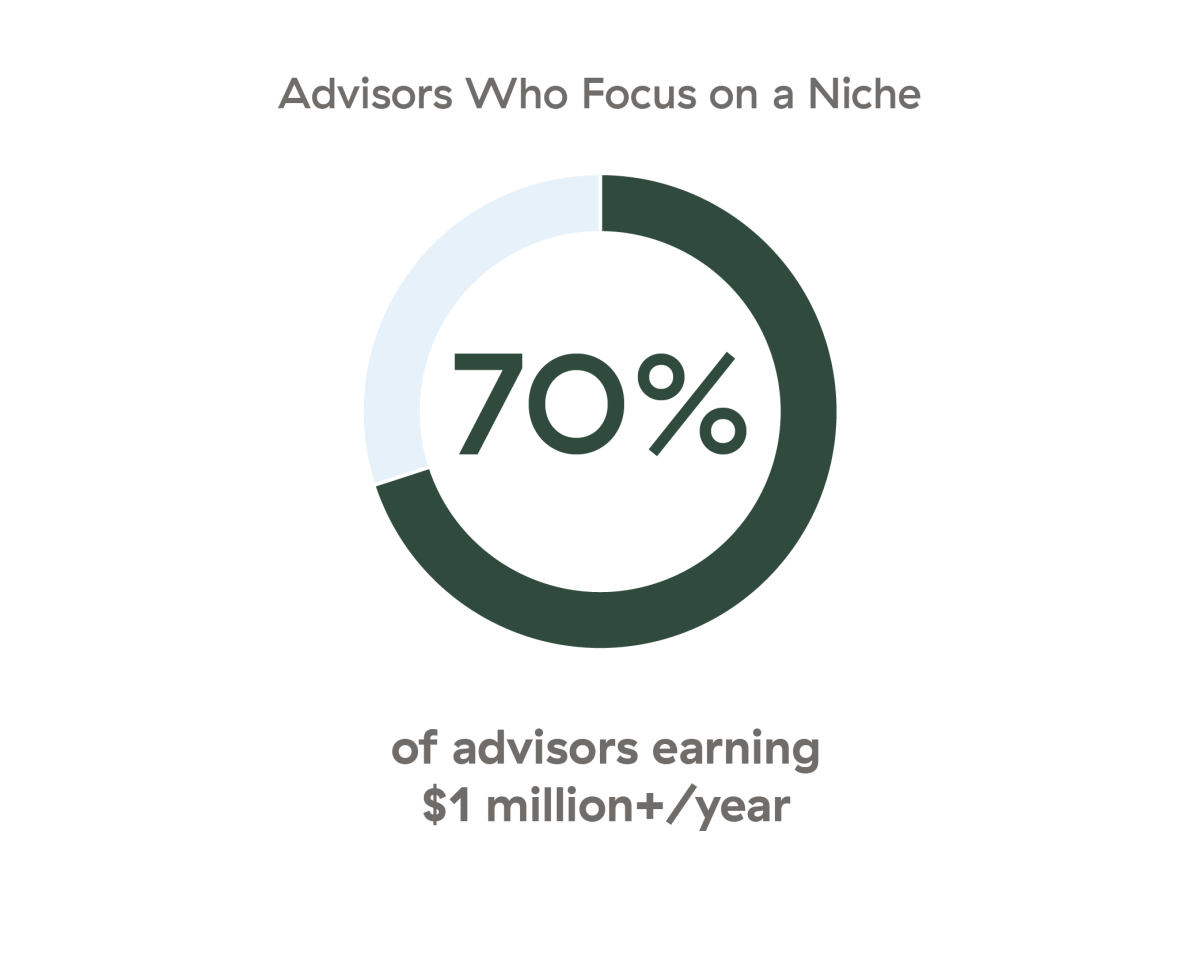

Developing your services around a niche can help with attracting ideal clients. Selecting an area you are interested in, have experience in, or have a passion for will help fuel your success. In fact, data collected by CEG Worldwide suggests that finding a niche focus could be a great next move to grow your firm:

Risk 4: Advances in Technology

It’s well documented that millennials favor financial advice supported by technology. A 2021 survey conducted by Roubini ThoughtLab uncovered the following data:

In light of these statistics, consider meeting virtually with younger clients, or use Twitter or LinkedIn to reach out to this group—just as they are using social media to learn more about you.

Because of the Covid-19 pandemic, technology has allowed us to continue working seamlessly from anywhere. While this is a blessing, it poses an additional risk we previously hadn’t considered. Your clients are comfortable and may feel that Zoom meetings are now the ‘’norm,’’ so there may not be a strong desire to meet in person or to have an advisor with a local presence.

The ability to clearly articulate the value you deliver to clients is more important than ever. To stay competitive, consider the following actions:

Check your search results. Google yourself and your firm to see what the search returns. If necessary, enhance your website to accurately reflect both your professional and personal identities. This shift could help you stand out from the other wealth managers and financial advisors promoting themselves online.

Invest in new technology. Technology has also affected trading tools and automation by facilitating timely trades and the delivery of sophisticated investment strategies as well as creating more safeguards against market downturns. Your ability to use these tools may be the decisive, strategic edge to attract clients. Plus, investing in technology can create efficiencies, drive profitability, and enable you to continue to thrive.

Risk 5: Human Capital Management

Even with the rise of robo-advisors, don’t underestimate the human touch. Your market knowledge and financial planning and decision-making skills should always give you an edge over robo-advisors. But you’ll need to do your part in helping clients recognize your value by employing the best-of-the-best humans to work with them.

A human resources manager can help ensure smart hires. If smart hiring practices are not used, your advisory business could face a range of human capital risks, such as:

Failure to attract employees

The hiring of the wrong person

Unsatisfactory performance

Turnover

Absenteeism

Accident/injury

Fraud

Legal/compliance issues

Any of these risks could interrupt your business, and two or three at the same time could seriously disrupt it.

Risk 6: Increased Regulation

You’re well aware that the SEC regulates financial firms. Yet, debacles like the Enron and Wells Fargo scandals, Bernie Madoff, and the 2008 financial crisis happened—and we can expect similar events to continue to happen. Most advisors expect more, not fewer, regulations in the future.

In the current environment, increased regulations require careful planning and allocation of resources to ensure that compliance does not derail the profitability of your firm. To keep abreast of industry changes, review FINRA’s report on its examination and risk monitoring priorities for 2022.

Risk 7: Scale and Capacity

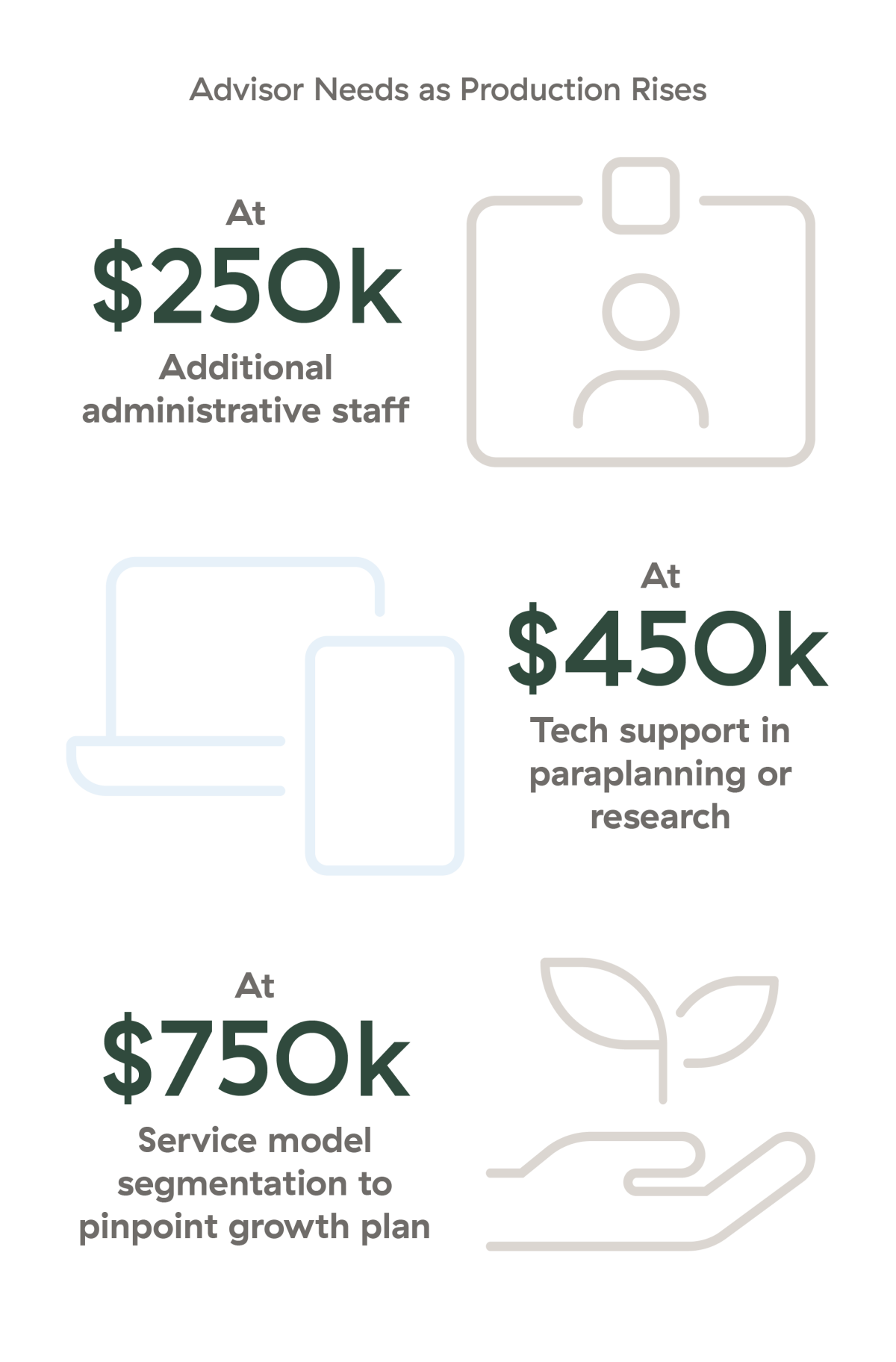

Here at Commonwealth, our Practice Management team has observed that advisors tend to experience "pain points" at predictable intervals:

How can you deal with inflection points such as these? Start by creating repeatable office procedures, as well as understanding revenue distribution among clients, profitability by client, and optimal service models. If you have staff, work with them to help with these tasks—they typically know the office procedures and workflows intimately and may have ideas to improve them.

Risk 8: Advisor Protection

When it comes to protecting yourself, consider an old insurance sales question: “If you had a money machine in your basement that pumped out $600,000 a year, would you insure it?” Of course, the punch line is that you are the money machine. Are you protecting yourself against the losses that could derail your money machine? Significant loss threats include advisor death or disability, key person loss, an unexpected disaster (natural or otherwise), lawsuits, and failure to plan for business succession.

Best practices include insurance and continuity plans to protect those assets you cannot afford to lose. So, be sure to perform annual reviews to update these plans in response to changing market conditions.

Addressing the Likelihood of Risk at Your Firm

Now that we’ve covered some common business risks, take these next three steps:

Draw a risk matrix with four quadrants.

Label the row headers with the consequences of risk and the column headers with risk likelihood.

Brainstorm the risks you perceive in your firm and categorize them.

Lastly, use the following strategies to address every risk in your quadrant matrix:

6 Strategies to Build a Better Business Plan

Develop a vision. Where do you want to be in three years? What would you like to accomplish?

Assess your firm using SWOT (strengths, weaknesses, opportunities, and threats) analysis. The goal is to understand your firm’s strengths and weaknesses on the inside and opportunities and threats on the outside.

Create strategic directives. What actions can you take to achieve your firm’s vision while keeping risk reduction in mind?

Define meaningful annual goals. Use SMART goals—strategic, measurable, achievable, realistic, and time-bound.

Implement a plan of action. List tasks and timelines to achieve your goals. A wise person once said, “At some point, everything degenerates to work.”

Review annually. By building time to track goals, you’ll be able to adjust your plan accordingly.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.